Small businesses are the backbone of the United Kingdom’s economy, comprising over 99% of all businesses and employing a significant portion of the workforce. As of January 2024, there were approximately 5.5 million small and medium-sized enterprises (SMEs) in the UK, accounting for 60% of employment and 48% of business turnover. However, navigating the complex landscape of accounting presents numerous challenges that can impede growth and sustainability. This article delves into the top 10 accounting challenges faced by small businesses in the UK for 2024-2025, supported by the latest data and insights.

1. Cash Flow Management

Effective cash flow management remains a critical concern for small businesses. A staggering 82% of business failures are attributed to cash flow problems. The recent economic climate, marked by inflation and rising operational costs, has exacerbated this issue, making it imperative for businesses to monitor and manage their cash flow meticulously.

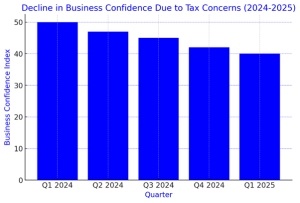

2. Navigating Taxation and Regulatory Changes

The UK’s tax landscape is continually evolving, presenting challenges for small businesses striving to remain compliant. In the third quarter of 2024, business confidence declined due to tax concerns, with 29% of companies perceiving the tax burden as a growing challenge. Upcoming changes, such as increased National Insurance contributions and adjustments to the National Minimum Wage, further complicate financial planning and forecasting.

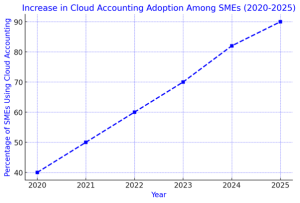

3. Technological Integration and Automation

The rapid advancement of technology offers both opportunities and challenges. While automation and AI can streamline accounting processes, integrating these technologies requires investment and expertise. By 2024, over 75% of firms reported increased spending on technology, with many adopting AI and automation to enhance efficiency. However, selecting the right tools and ensuring staff are adequately trained remains a significant hurdle.

4. Recruitment and Retention of Skilled Personnel

Labour shortages continue to plague small businesses, with nearly 30,000 firms projected to fail in 2024, partly due to staffing challenges. Attracting and retaining qualified accounting professionals is particularly difficult, as small businesses often cannot compete with larger firms in terms of salaries and benefits.

5. Compliance with Financial Reporting Standards

Adhering to financial reporting standards, such as the International Financial Reporting Standards (IFRS), is essential but complex. Non-compliance can lead to legal repercussions and financial penalties. Many small businesses struggle with the intricacies of these standards due to limited resources and expertise.

6. Cybersecurity and Data Protection

With the increasing reliance on digital platforms, cybersecurity has become a paramount concern. Small businesses are often targeted by cyberattacks due to perceived vulnerabilities. Implementing robust cybersecurity measures is essential to protect sensitive financial data and maintain client trust.

7. Managing Operational Costs

Inflation and rising energy costs have significantly impacted operational expenses. Businesses continue to face rising operational costs, with energy prices remaining high, putting further strain on SMEs. Effective cost management strategies are crucial to maintain profitability in this challenging economic environment.

8. Access to Funding and Capital

Securing funding is a perennial challenge for small businesses. Limited access to capital can hinder growth and innovation. Understanding the various funding options and preparing robust financial statements are essential steps in attracting potential investors or securing loans.

9. Adapting to Market Changes

The business landscape is continually evolving, influenced by geopolitical events, economic shifts, and changing consumer behaviors. Small businesses must remain agile, adapting their accounting practices to reflect current market conditions and ensure financial resilience.

10. Strategic Financial Planning

Long-term financial planning is often overshadowed by immediate concerns. However, strategic planning is vital for sustainable growth. This includes budgeting, forecasting, and setting financial goals aligned with the business’s vision. Without a strategic plan, businesses may struggle to navigate financial uncertainties and capitalize on opportunities.

How Insights UK Can Assist

Navigating these challenges requires expertise and tailored solutions. Insights UK offers comprehensive accounting advisory services designed to support small businesses in the UK. Our services include:

- Financial & Risk Advisory: Assisting in developing efficient financial reporting processes that adhere to IFRS standards, ensuring accuracy and compliance.

- Tax Advisory: Providing guidance on navigating complex tax regulations, helping businesses optimize their tax strategies and remain compliant amidst changing laws.

- Cloud Accounting Solutions: Implementing and managing cloud-based accounting systems to enhance efficiency, accuracy, and accessibility of financial data.

- Corporate Finance & Deal Advisory: Offering support in securing funding, financial planning, and strategic decision-making to foster business growth.

By partnering with Insights UK, small businesses can leverage specialized knowledge and tools to overcome accounting challenges, ensuring financial stability and positioning themselves for success in the dynamic UK market.

FAQs

What is the biggest accounting challenge for small businesses?

The biggest accounting challenge for small businesses is cash flow management. Many small businesses struggle with maintaining a steady cash flow due to delayed payments from customers, unexpected expenses, or poor budgeting. Keeping track of income and expenses, setting clear payment terms, and using accounting software to monitor finances can help overcome this challenge.

How can small businesses improve cash flow management?

Small businesses can improve cash flow management by:

- Creating a cash flow forecast to anticipate income and expenses.

- Encouraging customers to make timely payments by offering discounts for early payments.

- Reducing unnecessary expenses and negotiating better terms with suppliers.

- Using cloud-based accounting software to track real-time cash flow.

- Having a financial cushion to manage unexpected shortfalls.

Do I need an accountant for my small business in the UK?

While it is not legally required to have an accountant, hiring one can be highly beneficial. An accountant can help with tax compliance, VAT returns, bookkeeping, and financial planning. If you prefer to manage finances yourself, using accounting software can simplify the process, but an accountant can ensure accuracy and save time, particularly during tax season.

What accounting software is best for UK small businesses?

Some of the best accounting software for UK small businesses include:

- Xero – Ideal for small businesses needing cloud-based accounting with automation features.

- QuickBooks – Great for businesses that require invoicing, payroll, and VAT management.

- Sage Business Cloud – Suitable for UK businesses needing robust tax and compliance features.

- FreeAgent – Designed for freelancers and small business owners managing self-assessment tax returns.

- Zoho Books – A budget-friendly option with essential accounting features.

How can I avoid VAT penalties?

To avoid VAT penalties, small businesses should:

- Ensure VAT returns are filed on time to avoid late filing penalties.

- Keep accurate and up-to-date records of all VAT transactions.

- Use accounting software that integrates VAT calculations and submissions to HMRC.

- Stay informed about VAT threshold changes and obligations.

- Seek advice from an accountant or VAT expert to ensure compliance with regulations.

Sources:

- https://researchbriefings.files.parliament.uk/documents/SN06152/SN06152.pdf

- https://www.hostinger.co.uk/tutorials/small-business-statistics

- https://www.reuters.com/world/uk/tax-worries-knock-uk-business-confidence-survey-shows-2024-10-08/

- https://theledgerlabs.com/accounting-trends-small-businesses/

- https://startups.co.uk/news/small-business-challenges-2024/

- https://firestartersolutions.co.uk/top-sme-business-challenges/