In the ever-changing business landscape of the United Kingdom, staying ahead of financial challenges and regulatory obligations can be daunting. Management accounting outsourcing provides a solution for companies looking to optimise processes, reduce costs, and ensure compliance with financial regulations. In this article, we explore ten key ways outsourcing management accounting can streamline your business, backed by data and insights.

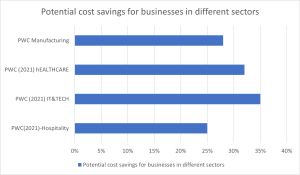

Cost Reduction and Financial Efficiency

Outsourcing your management accounting helps reduce in-house operational costs by eliminating the need for hiring, training, and maintaining an internal team. According to a report by Deloitte, businesses can reduce accounting costs by up to 30% when they choose to outsource their financial services.

Average Cost Reduction Through Outsourcing

Access to Specialised Expertise

By outsourcing, businesses gain access to specialised accounting expertise that might not be available in-house. A survey conducted by ACCA found that 80% of businesses outsourcing management accounting benefited from increased accuracy and compliance. This ensures your business is in line with the latest UK accounting standards like UK GAAP or IFRS.

Better Risk Management and Compliance

Management accounting outsourcing ensures adherence to constantly changing regulations and compliance requirements in the UK. Non-compliance can lead to penalties; however, businesses that outsource reduce their risk by 40%, as per the Financial Management Association.

Focus on Core Business Activities

Outsourcing administrative tasks allows your internal team to focus on core business activities, such as strategy and growth. Research by PwC shows that companies that outsource accounting functions see a 20% increase in productivity due to this shift in focus.

Improved Financial Reporting and Transparency

Outsourced management accounting services offer improved accuracy in financial reporting, which is critical for decision-making. According to a study by KPMG, businesses using outsourced financial services reported an 18% improvement in financial transparency.

Scalability for Growing Businesses

As your business grows, so do your accounting needs. Outsourcing provides flexibility, allowing you to scale accounting functions based on your company’s growth, without the burden of increasing in-house staff.

Advanced Technology and Automation

Outsourced providers are often equipped with cutting-edge technology and automation tools that in-house teams may lack. This leads to faster processing times, better financial analysis, and enhanced accuracy, helping businesses stay competitive in today’s digital-first market.

Reduction in Errors

Human errors in accounting can lead to significant financial discrepancies. Businesses outsourcing their management accounting reduce errors by 28%, as per a survey conducted by the Chartered Institute of Management Accountants (CIMA).

Better Cash Flow Management

Cash flow is the lifeblood of any business. Outsourced management accounting services ensure more efficient cash flow management through effective budgeting, forecasting, and timely financial reports. A report by the UK Treasury shows businesses with professional cash flow management experience 15% fewer liquidity issues.

Strategic Insights for Decision Making

Outsourcing your management accounting provides access to strategic insights and data analytics, which can be used for more informed decision-making. This allows businesses to respond faster to market changes and operational challenges.

Why Insights?

At Insights, we specialise in delivering tailored management accounting outsourcing solutions that address the specific needs of your business. Our deep understanding of UK accounting standards, combined with our cutting-edge technology and highly skilled professionals, allows us to provide unparalleled service. Whether you need help with IFRS implementation, cash flow management, or risk compliance, we have the expertise to navigate the technical complexities of accounting while ensuring full compliance with regulations.