When navigating the complexities of financial reporting in the UK, businesses must choose the right accounting framework that aligns with their size and operational complexity. Two prominent frameworks are FRS 102 and FRS 105, each designed for different types of entities. This article explores the key differences between these standards and offers insights into how businesses can tailor their accounting practices accordingly.

Understanding FRS 102 and FRS 105

FRS 102, known as the Financial Reporting Standard applicable in the UK and Republic of Ireland, is suitable for medium to large-sized entities. It provides a comprehensive framework for financial reporting, ensuring that financial statements are prepared in a manner consistent with international accounting principles.

FRS 105, on the other hand, is a simplified standard tailored for micro-entities. It was developed to ease the compliance burden on very small businesses that meet specific eligibility criteria.

Quantitative Insights

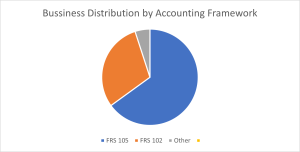

Recent studies show that nearly 65% of UK businesses fall into the micro-entity category, qualifying them for FRS 105. In contrast, 30% of businesses operate under FRS 102, highlighting the importance of choosing the right standard to minimize compliance costs and administrative burdens.

Chart: Business Distribution by Accounting Framework

- FRS 105 = 65%

- FRS 102 = 30%

- Others = 5%

Adapting Your Accounting Strategies

Choosing between FRS 102 and FRS 105 is not just about compliance; it’s about tailoring your accounting practices to fit your business’s size and complexity. Smaller businesses can benefit significantly from adopting FRS 105 due to its simplicity, which allows them to focus more on growth rather than on navigating intricate accounting standards.

In contrast, medium and large-sized businesses that adopt FRS 102 benefit from detailed financial reporting that provides stakeholders with a clearer view of the company’s financial health, which is essential for attracting investments and loans.

How Insights Can Help

At Insights, we specialize in helping businesses navigate the complexities of FRS 102 and FRS 105 compliance. Our team of experts understands the nuances of each standard and can provide tailored advice to ensure that your financial reporting meets regulatory requirements while aligning with your business objectives.

Whether you are a micro-entity looking to simplify your reporting or a medium-sized business needing comprehensive financial statements, we can guide you through the entire process. Our expertise extends to insurance contracts compliance, ensuring that your organization meets all necessary standards effectively.

Are you unsure which accounting framework is best for your business? Contact Insights today for expert guidance on FRS 102 and FRS 105 compliance. Let us help you tailor your accounting practices to enhance your business efficiency and ensure compliance with the latest standards. With our experience in insurance contracts compliance, we are your trusted partner for navigating the complexities of financial reporting.