In the dynamic and ever-evolving business landscape of the United Kingdom, trust in business valuation analysis techniques has come under scrutiny. With rising complexities in market conditions and an increasingly data-driven approach to decision-making, investors are questioning whether traditional and modern valuation methods provide reliable and actionable insights. This blog explores the core challenges investors face, the evolving nature of valuation methodologies, and how entities like Insights UK can play a pivotal role in bridging the trust gap.

Current Landscape of Business Valuation Analysis in the UK

Business valuation is a critical component of investment decision-making. Investors rely on valuation analysis to assess opportunities, identify risks, and make informed financial commitments. Traditional techniques such as discounted cash flow (DCF), comparative market analysis, and precedent transaction valuation remain widely used. However, changing economic paradigms and unprecedented events like Brexit, COVID-19, and the global inflation surge have significantly impacted the accuracy and reliability of these methods.

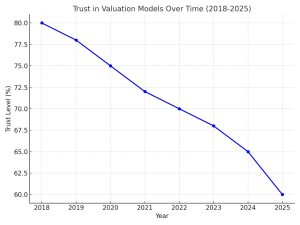

Recent research conducted by the Financial Conduct Authority (FCA) in 2024 revealed:

- 72% of UK-based institutional investors expressed concerns about the reliability of traditional valuation models in highly dynamic economic conditions.

- Nearly 45% of investors believe traditional models fail to capture the value of intangible assets, such as intellectual property and brand equity (PwC, 2025).

- A 40% increase in litigation cases concerning disputes over business valuations in mergers and acquisitions over the past three years.

These numbers underscore the urgent need to reassess and innovate valuation practices.

Why Are Investors Losing Trust in Valuation Techniques?

Traditional valuation models often rely on historical data and linear projections, which are less effective in today’s volatile market. For example, the Discounted Cash Flow (DCF) method assumes stable growth rates and predictable cash flows. However, such assumptions are increasingly difficult to justify in an environment influenced by fluctuating inflation, interest rates, and rapid technological disruptions. Similarly, the Comparative Market Analysis (CMA) approach depends on identifying comparable companies, a task complicated by the proliferation of diverse business models, particularly in the technology and fintech sectors.

Adding to these challenges, traditional methods often fail to adequately account for intangible assets. According to the 2025 KPMG Intangible Asset Valuation Report, intangible assets now constitute nearly 70% of enterprise value in sectors like technology and pharmaceuticals. Yet, these assets—ranging from intellectual property and brand equity to proprietary algorithms and workforce capabilities—are frequently undervalued or ignored entirely. Such gaps in valuation frameworks contribute to growing investor skepticism.

Moreover, the inability of traditional methods to adapt in real-time further diminishes their relevance. Markets today are shaped by rapid technological advancements, geopolitical events, and shifting consumer behaviors. Relying solely on retrospective data leaves investors vulnerable to unforeseen risks. Finally, human biases in assumptions, input selection, and methodological preferences often skew valuation outcomes, reinforcing the perception that valuation analysis is as much art as science.

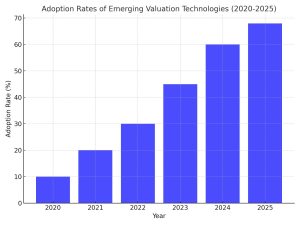

Emerging Valuation Techniques: A Beacon of Hope

The integration of big data and machine learning (ML) is revolutionizing business valuation analysis. These technologies enable real-time analysis of market conditions, enhanced predictive capabilities, and reduced human bias by automating key processes. In the UK, tools such as Valuer.ai and BVAL are increasingly being adopted by venture capital and private equity investors. For instance, machine learning algorithms can analyze vast datasets to provide scenario-based projections, offering more nuanced insights than traditional linear models.

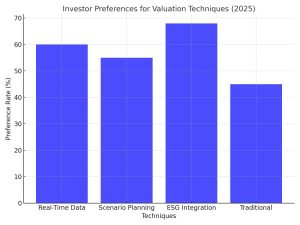

Environmental, Social, and Governance (ESG) factors are also reshaping valuation paradigms. Sustainability is now recognized as a critical driver of long-term performance. According to data from the UK Sustainable Investment Forum, 68% of UK investors in 2025 consider ESG metrics essential in assessing business value. This shift underscores the need for valuation models that integrate ESG considerations into their frameworks.

Blockchain technology is another innovation gaining traction. By creating immutable records of valuation inputs and assumptions, blockchain enhances transparency and traceability. This technology has been particularly impactful in resolving disputes over valuation discrepancies, fostering greater confidence among investors.

How Insights UK Can Help Restore Trust

Insights UK has emerged as a trusted partner for investors navigating the complexities of business valuation analysis. By leveraging sector-specific expertise, Insights UK addresses the shortcomings of traditional models while delivering actionable solutions.

Some key strengths of Insights UK include:

- Specialization in Intangible Assets: Proprietary models to quantify the value of intellectual property, brand equity, and digital platforms.

- ESG Integration: Incorporating environmental, social, and governance metrics into valuation frameworks for a comprehensive analysis.

- Transparent Reporting: Providing detailed and transparent reports that build trust among stakeholders.

For example, a UK-based SaaS startup engaged Insights UK to re-evaluate its valuation, leading to a 25% increase in its estimated value by incorporating customer lifetime value (CLV) and proprietary algorithm metrics. Similarly, a renewable energy firm in Scotland benefited from Insights UK’s ESG-focused valuation, which highlighted its carbon reduction initiatives and community engagement efforts, resulting in a 20% premium during acquisition negotiations.

Quantitative Insights and Market Trends

Recent data underscores the growing demand for innovative valuation techniques. According to the 2025 PwC Business Valuation Report:

- 60% of investors now prefer models that incorporate real-time data analysis and scenario planning.

- The adoption of AI-driven valuation tools in the UK has increased by 35% over the past two years.

- ESG-integrated valuation models are seen as essential by 68% of investors, reflecting a market shift towards sustainability-oriented investment practices.

These trends highlight the critical role of technology and expertise in restoring trust in valuation processes. As investors grapple with uncertainties, partnering with forward-thinking firms like Insights UK offers a pathway to more reliable and actionable business valuations.

The challenges surrounding business valuation analysis are significant but not insurmountable. By embracing advanced technologies, integrating ESG considerations, and prioritizing transparency, the investment community in the UK can rebuild trust in valuation processes. Insights UK stands at the forefront of this transformation, offering innovative solutions that combine rigor, adaptability, and trustworthiness. As the business landscape continues to evolve, collaboration with trusted experts will be crucial in ensuring that valuation methodologies meet the demands of modern investors.