In an increasingly complex business environment, conducting thorough reliable due diligence is essential to minimise risks, ensure compliance, and make informed decisions. Whether you’re considering an acquisition, a merger, or a significant investment, due diligence provides the critical insights needed to safeguard your interests and avoid potential pitfalls. UK businesses, particularly those involved in cross-border transactions, must ensure that their due diligence processes are both rigorous and reliable.

Understanding Due Diligence

Due diligence is the investigation and evaluation of a business or individual before entering into a transaction or a formal agreement. The process aims to confirm all relevant facts, assess potential risks, and provide a comprehensive view of the target company’s financial, legal, and operational standing.

Types of Due Diligence

Due diligence can take several forms depending on the nature of the transaction and the specific risks involved. The most common types include:

- Financial Due Diligence: This involves a detailed review of the target company’s financial statements, tax records, and accounting policies. The goal is to confirm the company’s financial health, assess profitability, and identify any red flags that could impact the transaction’s value or viability.

- Legal Due Diligence: Legal due diligence focuses on evaluating the legal risks associated with a business transaction. It includes reviewing contracts, regulatory compliance, intellectual property rights, and litigation history.

- Operational Due Diligence: This type of due diligence assesses the operational aspects of the target company, including supply chain, production capabilities, customer relationships, and management practices.

- Commercial Due Diligence: Commercial due diligence involves analysing the target company’s market position, competitive landscape, and growth potential.

- Environmental Due Diligence: For businesses in industries with environmental regulations, this type of due diligence assesses the target’s compliance with environmental laws and potential liabilities.

The Importance of Due Diligence in Risk Mitigation

The primary purpose of due diligence is to reduce risks and ensure that businesses make informed decisions. Without proper due diligence, companies may enter into agreements or transactions that could lead to financial loss, legal issues, or reputational damage.

How Due Diligence Mitigates Risks:

- Identifying Financial Risks: Financial due diligence helps uncover potential issues such as inaccurate financial reporting, hidden debts, or tax liabilities.

- Legal and Regulatory Compliance: Legal due diligence ensures compliance with relevant laws and reduces the risk of future legal disputes.

- Operational Efficiency: Operational due diligence helps to identify inefficiencies or risks in the company’s supply chain, production, or other areas.

- Strategic Alignment: Commercial due diligence evaluates whether the target company’s market position aligns with strategic objectives.

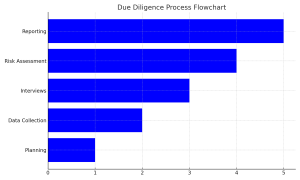

Key Steps in the Due Diligence Process

A reliable due diligence process is systematic, detailed, and thorough. It involves several key steps:

- Planning and Scoping: This involves defining the areas that require investigation, such as financials, legal compliance, or operations.

- Data Collection and Analysis: Gathering relevant data such as financial statements, contracts, and legal documents is essential.

- Interviews and Site Visits: Conducting interviews with key personnel and visiting the company’s facilities provide additional insights.

- Risk Assessment: A detailed risk assessment identifies and prioritises potential risks based on likelihood and impact.

- Reporting and Recommendations: The findings are compiled in a report, outlining risks, red flags, and recommendations.

Below is an example graph showcasing a typical due diligence process:

The Role of Professional Due Diligence Services in the UK

Professional due diligence services are essential for ensuring that the process is conducted thoroughly and accurately. These services provide expert analysis and objective assessments that help businesses avoid costly mistakes and make sound decisions.

Successful Risk Mitigation through Due Diligence

A UK-based manufacturing company was considering acquiring a smaller competitor to expand its market share. The target company’s financial statements appeared healthy, but the acquiring company engaged a professional due diligence service to conduct a comprehensive review.

When to Engage Due Diligence Services

Due diligence services should be engaged when acquiring or merging, raising capital, entering joint ventures, and purchasing significant assets. Due diligence is a crucial process for UK businesses looking to minimise risks and make informed decisions. Professional due diligence services provide the expertise, tools, and objectivity needed to ensure that transactions are conducted smoothly and without unforeseen complications. In the UK, due diligence is a critical component of any corporate transaction. It helps businesses ensure compliance with local regulations, protect against fraud, and verify the financial health and strategic position of potential partners or acquisition targets.