In today’s fast-paced and highly regulated business environment, internal audits have become a cornerstone for ensuring operational efficiency, compliance, and risk mitigation. Yet, red flags in internal audit risk assessments often go unnoticed, leaving organizations vulnerable to financial losses, regulatory penalties, and reputational harm. Are these vulnerabilities hiding in your processes? Let’s dive deeper into the risks, assess their costs, and identify strategies to elevate your audit framework for long-term resilience.

The Current Landscape of Internal Audits in 2024

Internal audits in 2024 are more nuanced and challenging than ever, driven by evolving regulations, technological advancements, and heightened expectations from stakeholders. Here are the key dynamics shaping the field:

1. Increasing Regulatory Complexity

The UK’s regulatory framework has expanded significantly, with new compliance requirements in critical sectors such as finance, healthcare, and technology. In 2024, regulatory penalties averaged £750,000 per incident, with 30% of fines stemming from inadequate risk assessments.

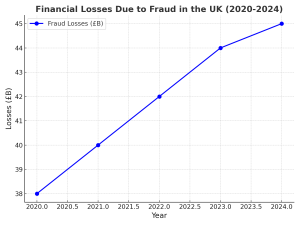

2. Rising Fraud Risks

A 2024 report by the Association of Certified Fraud Examiners (ACFE) estimates that UK businesses lose 5% of their annual revenue to fraud, amounting to over £45 billion annually. Of these cases, 60% were attributed to gaps in internal controls and audit processes.

3. Technological Transformation

Emerging technologies such as AI, blockchain, and advanced data analytics are revolutionizing internal audits. However, they also introduce vulnerabilities. A 2024 survey revealed that 45% of UK businesses identified cybersecurity risks as a major concern in their audit assessments.

4. Supply Chain Vulnerabilities

Global supply chain disruptions have heightened focus on operational risks. In 2024, 35% of UK companies reported financial losses directly linked to insufficient supplier audits.

Identifying Red Flags in Internal Audit Risk Assessments

Red flags in internal audit risk assessments often signal deeper inefficiencies or vulnerabilities. Here are some critical warning signs to watch for:

1. Outdated Risk Assessment Frameworks

Legacy frameworks fail to address emerging risks effectively. A 2024 KPMG study highlighted that 30% of UK organizations still rely on outdated assessment methods, leaving them exposed to dynamic threats.

2. Misalignment with Strategic Goals

When audits function in isolation from broader organizational objectives, critical risks can be overlooked. In 2024, 25% of internal audits were found to lack alignment with strategic priorities, undermining their value.

3. Insufficient Documentation

Incomplete or inconsistent documentation is a pervasive issue. Missing records accounted for 40% of deficiencies flagged in regulatory reviews in 2024, undermining the credibility of audit findings.

4. Over Reliance on Manual Processes

Despite advancements in technology, 50% of businesses still depend heavily on manual audit procedures. This reliance increases human error, inefficiency, and inconsistencies in reporting.

5. Poor Follow-Up Mechanisms

Failing to act on audit findings is a persistent issue. In 2024, 33% of organizations reported recurring issues due to delayed or inadequate implementation of corrective actions.

The Hidden Costs of Neglecting Audit Red Flags

Ignoring red flags in internal audit risk assessments can result in cascading consequences that extend beyond financial losses. Here are the most significant impacts:

1. Financial Losses

Unchecked risks such as fraud, inefficiencies, and compliance failures can drain resources. In 2024, financial losses linked to poor internal audits exceeded £10 billion in the UK.

2. Regulatory Penalties

Non-compliance with regulations leads to significant penalties. The Financial Conduct Authority (FCA) imposed fines totaling £1.8 billion in 2024, with internal audit failures contributing to 40% of cases.

3. Reputational Damage

A company’s reputation can suffer long-term damage from audit failures. A 2024 PwC survey found that 60% of investors are less likely to back companies with a history of compliance or audit deficiencies.

4. Increased Insurance Premiums

Companies with subpar risk management records face higher insurance costs. Businesses with multiple audit failures saw an average 20% increase in premiums in 2024.

Strengthening Internal Audit Risk Assessments

Robust internal audit risk assessments require a structured, proactive approach that evolves with changing risks. Here’s how organizations can enhance their processes:

1. Adopt a Risk-Based Audit Approach

Focus on high-impact areas by prioritizing risks based on severity and likelihood. This approach ensures that critical vulnerabilities are addressed promptly.

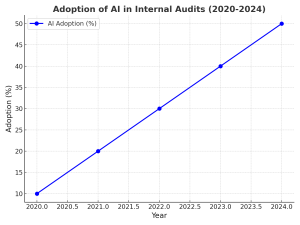

2. Integrate Advanced Technology

Leverage AI and analytics tools to enhance accuracy and efficiency in audits. Organizations utilizing AI-driven solutions in 2024 reported 30% faster risk identification and 25% fewer missed vulnerabilities.

3. Enhance Team Expertise

Equip audit teams with the necessary skills to handle emerging risks. Certifications such as CIA (Certified Internal Auditor) and regular training are essential for staying ahead of evolving challenges.

4. Improve Governance and Accountability

Establish clear lines of accountability and transparent communication channels among the audit committee, management, and board. Effective governance fosters decisive action and improves compliance.

5. Update Audit Frameworks Regularly

Audit frameworks should be dynamic and responsive to new risks. Annual reviews help incorporate regulatory changes, technological advancements, and evolving business strategies.

6. Strengthen Follow-Up Mechanisms

Develop robust systems for tracking and implementing corrective actions. Reporting progress to stakeholders ensures accountability and builds trust in the audit process.

How Insights UK Can Help

Navigating the complexities of internal audit risk assessments requires a combination of expertise, advanced tools, and strategic insight. This is where Insights UK excels. Their tailored solutions empower organizations to mitigate risks effectively and enhance their audit frameworks. Here’s how they can assist:

- Comprehensive Risk Identification: Utilizing cutting-edge analytics to uncover and prioritize risks across your operations.

- Technology Integration: Deploying AI and data-driven solutions to streamline and improve audit accuracy.

- Skill Development Programs: Offering training and certification pathways to elevate the capabilities of internal audit teams.

- Enhanced Governance Practices: Designing frameworks that improve accountability and align audits with strategic objectives.

With Insights UK as your partner, you can transform internal audits into a powerful tool for resilience and growth.

The Future of Internal Audit Risk Assessments

As we approach 2025, the role of internal audit risk assessments will become even more pivotal. With increasing regulatory scrutiny, technological disruptions, and stakeholder expectations, organizations must invest in adaptive and forward-thinking audit practices.

Are red flags in your internal audits putting your organization at risk? Now is the time to act. By addressing vulnerabilities, embracing innovation, and partnering with experts like Insights UK, you can safeguard your business from significant losses and position yourself for sustained success.