When undertaking any significant project, the importance of robust financing cannot be overstated. Businesses across the UK are increasingly seeking project financing solutions tailored to their specific needs. However, without proper risk assessment, even the most meticulously planned financing strategies can lead to catastrophic failures. In this article, we will delve into the pivotal role of risk assessment in ensuring the success of your project financing solutions, backed by the latest data and trends in 2025.

Understanding Project Financing Solutions in the UK

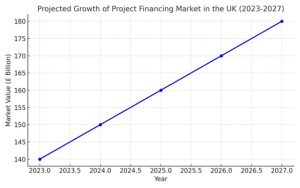

In the UK, project financing has become a cornerstone for industries such as infrastructure, renewable energy, and real estate. According to a 2025 report by the UK Project Finance Association (UKPFA), the project financing market is projected to reach a valuation of £180 billion by 2027, growing at a compound annual growth rate (CAGR) of 7.2%.

Businesses often rely on project financing to mitigate upfront capital requirements, share risks among stakeholders, and enhance the scalability of large-scale projects. These benefits make project financing an indispensable tool for modern enterprises. However, the absence of a robust risk assessment can quickly turn this opportunity into a liability. Many projects, despite having secure financing, falter due to unforeseen challenges, leading to delays, financial losses, and even abandonment. Nearly 68% of UK projects experienced budget overruns, primarily due to unmitigated risks.

The Consequences of Neglecting Risk Assessment

Neglecting risk assessment is a critical error that can have far-reaching consequences. One of the most significant issues is financial overruns. Projects without proper risk evaluations often fail to anticipate fluctuating market conditions or unforeseen expenses. This frequently results in budgets spiraling out of control. In fact, companies with inadequate risk strategies reported cost overruns exceeding 20% in over half their projects.

Delays are another inevitable outcome. Unaddressed risks such as supply chain disruptions or regulatory hurdles can stall progress, tarnishing reputations and eroding investor confidence. A study in 2025 found that 30% of UK-based projects experienced significant delays directly attributable to insufficient risk management.

Moreover, stakeholder disputes become more common in the absence of transparent risk-sharing frameworks. These disputes often undermine trust and hinder long-term collaboration. Non-compliance with regulatory changes compounds these issues, leading to fines or even project shutdowns. Navigating the UK’s evolving regulatory landscape demands proactive risk assessment practices.

Key Components of Risk Assessment in Project Financing

A comprehensive risk assessment framework comprises several critical steps. Identifying risks is the first and perhaps the most crucial stage. Projects in the UK often face market risks, such as price volatility and demand fluctuations. Operational risks, including equipment failures and workforce inefficiencies, are equally prevalent. Financial risks like currency and interest rate fluctuations pose challenges, while regulatory risks add an additional layer of complexity.

Quantifying risks is the next step. Accurate measurement of the likelihood and impact of risks is essential for effective planning. Advanced tools like Monte Carlo simulations and sensitivity analyses have become standard in the industry. 64% of UK businesses now employ AI-driven tools for risk quantification, reducing forecasting errors by up to 40%.

Mitigation strategies are tailored to the quantified risks. Financial risks, for instance, can be hedged using instruments like forward contracts. Operational risks require robust contingency plans, including backup suppliers and alternative workflows. Regulatory risks demand constant vigilance and collaboration with experienced consultants. The UK government’s Green Finance Strategy update in 2025 emphasizes embedding sustainability into risk mitigation, a move that has reduced compliance-related risks by 25% across the board.

Finally, monitoring risks ensures that projects remain resilient against evolving challenges. Real-time dashboards and automated alerts help businesses adapt quickly to emerging threats, preventing minor issues from escalating into major setbacks.

The Impact of Effective Risk Management

The importance of risk management is evident in quantitative terms:

- Financial Stability: Companies with comprehensive risk frameworks reported a 40% reduction in financial overruns. This highlights the ability of robust strategies to contain costs and prevent budgetary crises.

- Reduction in Delays: Effective risk assessment led to a 30% decrease in project delays. With advanced forecasting tools, businesses were able to anticipate challenges and take timely corrective actions.

- Enhanced Collaboration: Stakeholder disputes dropped by 25% as businesses implemented transparent risk-sharing mechanisms. This fostered greater trust and smoother project execution.

- Improved Cost Accuracy: The integration of AI and predictive analytics led to a 20% improvement in cost accuracy. This ensures better financial planning and resource allocation.

- Increased Completion Rates: Projects using advanced risk management tools experienced a 15% increase in completion rates within expected timelines, reinforcing the importance of technology in managing uncertainties.

How Insights UK Can Help

- Comprehensive Solutions: At Insights UK, we specialize in delivering tailored solutions for project financing solutions. Our strategies address specific project needs to ensure resilience and adaptability in today’s rapidly changing environment.

- Bespoke Risk Assessment Frameworks: We design risk assessment frameworks using advanced tools like predictive analytics and machine learning. These technologies enable precise risk quantification, helping businesses make informed, data-driven decisions while reducing uncertainties.

- Expert Regulatory Guidance: With decades of expertise, our consultants provide guidance to navigate the UK’s complex regulatory landscape, ensuring compliance and strategic alignment throughout the project lifecycle.

- Continuous Monitoring: We offer real-time insights and monitoring to proactively address emerging risks. This approach minimizes delays and prevents financial overruns, keeping projects on track even during volatile conditions.

- Dedicated Team and Cutting-Edge Solutions: Partnering with Insights UK provides access to innovative solutions and a dedicated team focused on the long-term success of your project.

Emerging Trends in Risk Assessment for 2025 and Beyond

Sustainability as a Core Element

Sustainability has become a focal point in risk assessment, with the UK’s commitment to net-zero emissions by 2050 driving significant changes. Incorporating Environmental, Social, and Governance (ESG) criteria is now essential for securing funding and enhancing risk resilience. Projects aligned with ESG principles have reported a 15% increase in investor interest, according to the UK Green Finance Report 2025.

The Role of Digital Transformation

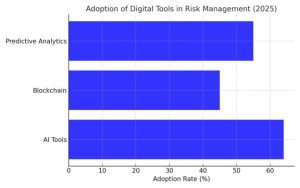

Digital transformation is another key trend. Technologies like blockchain and AI are revolutionizing risk management by enhancing transparency and predictive capabilities. Blockchain ensures secure documentation, reducing fraud risks, while AI-driven insights enable businesses to anticipate and address challenges proactively. By 2025, over 60% of large UK enterprises are expected to fully integrate these technologies into their risk frameworks.

Emphasis on Global Collaboration

Global collaboration is increasingly necessary for cross-border projects. This trend demands a broader perspective, considering geopolitical, cultural, and economic factors. Adhering to international standards and partnering with global experts can significantly improve project success rates. The UK’s robust trade relationships with Europe and emerging markets make this approach particularly relevant.

Building Resilience Post-Pandemic

Resilience building remains a priority post-pandemic. Businesses are investing in supply chain diversification and robust contingency planning to mitigate disruptions. A 2025 survey by the Confederation of British Industry (CBI) found that 72% of UK companies are actively enhancing their resilience measures to ensure continuity.

Regulatory Adaptability for Success

Finally, regulatory adaptability is critical. Frequent updates to UK laws, particularly those related to sustainability and digital innovation, require agile risk assessment practices. Staying ahead of these changes ensures compliance and reduces the risk of costly fines or operational shutdowns.

Without proper risk assessment, even the most promising project financing solutions are set to fail. The stakes are particularly high in the UK, where evolving market conditions and regulatory landscapes demand meticulous planning. By integrating advanced risk assessment practices, businesses can mitigate potential pitfalls and pave the way for success.

At Insights UK, we understand the complexities of project financing and offer tailored solutions to navigate them effectively. Contact us today to ensure your financing strategy is built on a foundation of resilience and foresight.