Investments are the lifeblood of economic growth and innovation, yet they carry an inherent risk. For those navigating the UK’s dynamic financial landscape, understanding the complexities of project finance risks can mean the difference between success and failure. These risks, often underestimated, can derail even the most well-conceived projects. The nuances of critical project finance risks, the potential repercussions for investors, and how Insights UK can provide the necessary tools and expertise to mitigate them.

The Multifaceted Nature of Project Finance Risks

Project finance risks span multiple dimensions, each with the potential to affect a project’s viability, profitability, and longevity. In 2025, the UK remains a hub for large-scale projects, including renewable energy developments, infrastructure upgrades, and technology innovation hubs. However, the complexity of these projects introduces significant vulnerabilities.

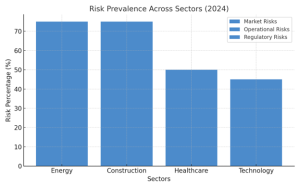

1. Market Risks

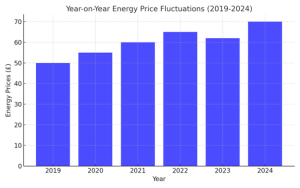

Market risks encompass price volatility, demand fluctuations, and competitive pressures. In the UK, renewable energy projects, for instance, face volatile energy prices and changing government policies, impacting returns on investment. The latest data from the UK’s Office for National Statistics (ONS) reveals that energy prices fluctuated by an average of 20% year-on-year in 2024, underscoring the challenge of predicting long-term market conditions.

2. Operational Risks

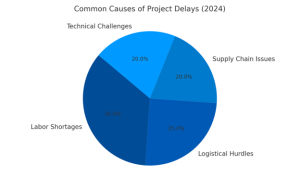

Operational risks involve inefficiencies or failures in the execution phase of a project. Construction delays, unforeseen technical challenges, and supply chain disruptions are key contributors. 45% of infrastructure projects exceeded their initial timelines due to labor shortages and logistical hurdles.

3. Financial Risks

Financial risks include changes in interest rates, currency exchange rates, and credit availability. With the Bank of England maintaining an interest rate of 4.25% as of January 2025, borrowing costs remain a critical factor in project financing.

Additional Quantitative Data:

- Average project cost overrun in the UK: 12% (2024).

- Percentage of projects relying on foreign currency financing: 35%.

4. Regulatory Risks

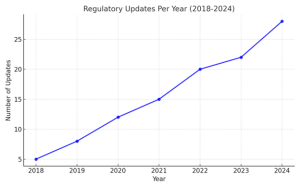

Regulatory risks stem from changes in laws, policies, and compliance requirements. The UK’s transition to net-zero emissions has accelerated regulatory changes, particularly in the energy and construction sectors. Sustainability Report highlights that 30% of companies faced compliance challenges due to evolving environmental standards.

5. Environmental and Social Risks

Projects today are scrutinized for their environmental and social impacts. ESG (Environmental, Social, and Governance) criteria are no longer optional. A recent survey shows that 62% of UK investors prioritize ESG compliance, making it a non-negotiable factor for project finance.

- Percentage of investors willing to pay a premium for ESG-compliant projects: 28%.

- Increase in ESG-focused funds in the UK (2020-2025): 54%.

Latest Quantitative Data on Project Finance Risks

| Risk Type | 2024 Statistics | 2025 Projections |

| Market Risks | 20% energy price volatility | Increased volatility due to geopolitical shifts |

| Operational Risks | 45% of projects delayed | 50%+ delays expected with labor market strain |

| Financial Risks | 4.0% interest rate average | Rates stabilizing at ~4.25% |

| Regulatory Risks | 30% compliance issues | Stricter standards for net-zero projects |

| Environmental Risks | 62% ESG prioritization by investors | 70%+ prioritization forecast |

Emerging Trends in Project Finance Risk Management

1. Rise of ESG-Centric Investments

Environmental and social factors are now central to investment decisions. Over 70% of UK-based funds integrate ESG metrics into their risk assessment processes. This shift underscores the growing importance of aligning financial goals with sustainability principles.

2. Technological Integration in Risk Mitigation

Artificial intelligence and machine learning are revolutionizing risk management. Predictive analytics enable investors to foresee potential challenges, while blockchain ensures greater transparency in financial transactions. By 2025, approximately 40% of UK financial institutions have adopted these technologies, as highlighted in a recent Accenture survey.

3. Collaboration Across Sectors

Public-private partnerships are gaining traction to share risks. For instance, the UK government’s involvement in infrastructure projects through strategic funding initiatives reduces the burden on private investors.

Practical Steps to Safeguard Your Investments

1. Building Resilient Supply Chains

Given the impact of global disruptions on supply chains, developing diversified sourcing strategies is crucial. A Resilience-focused supply chain can reduce operational risks by 30%.

2. Enhancing Stakeholder Engagement

Transparent communication with stakeholders fosters trust and ensures alignment with project objectives. Regular updates, combined with clear contingency plans, help mitigate misunderstandings and conflicts.

3. Continuous Monitoring and Adaptation

Adopting a proactive approach to monitoring risks enables timely interventions. Real-time data analytics tools offer insights into evolving market conditions, ensuring adaptability in decision-making.

Why Choose Insights UK?

In an era where project finance risks are escalating, partnering with experienced professionals is critical. Here’s how Insights UK can help:

Tailored Risk Management Solutions

- Insights UK leverages AI and machine learning to provide predictive risk models customized to your projects.

Comprehensive Market Insights

- Access the latest market data and trends, ensuring informed investment decisions.

Regulatory Expertise

- Stay compliant with evolving regulations through proactive guidance.

End-to-End Support

- From risk assessment to mitigation strategies, Insights UK offers holistic support throughout your project lifecycle.

Track Record of Success

- Trusted by leading UK investors, Insights UK has a proven history of helping clients navigate complex project finance risks.

FAQs

What are project finance risks?

Project finance risks refer to uncertainties that can impact the financial, operational, and strategic success of a project. These include market fluctuations, regulatory changes, operational delays, and environmental challenges.

How do project finance risks affect investors?

Investors may face reduced returns, increased costs, and potential project delays or cancellations due to unmanaged risks. Understanding and mitigating these risks is crucial for safeguarding investments.

Why is ESG compliance important in project finance?

ESG compliance ensures that projects align with environmental, social, and governance standards. It has become a critical factor for investors, with over 70% of UK funds now prioritizing ESG metrics in risk assessments.

How can technology help mitigate project finance risks?

Technologies like AI, blockchain, and predictive analytics enhance transparency, improve forecasting, and streamline compliance, making it easier to manage risks effectively.

What role does Insights UK play in managing project finance risks?

Insights UK provides tailored solutions, market insights, and regulatory expertise to help investors navigate the complexities of project finance risks, ensuring sustainable and profitable outcomes.

Critical project finance risks are an inevitable part of the investment landscape, especially in the UK’s dynamic economy. However, with the right strategies and expert guidance, these risks can be effectively mitigated. Whether dealing with market fluctuations, regulatory changes, or operational hurdles, proactive risk management is key.

By leveraging tailored solutions, cutting-edge tools, and industry expertise, Insights UK empowers you to navigate challenges with confidence. Whether you are planning a large-scale infrastructure project or a niche renewable energy venture, Insights UK ensures your investments remain resilient and profitable.