The IFRS 17 life insurance standard, which officially came into effect in January 2023, is transforming how insurance companies in the United Kingdom report their profitability. This regulation introduces a consistent, principle-based accounting framework for insurance contracts, significantly affecting financial statements, profitability measurement, and business strategies. The adoption of IFRS 17 life insurance is causing ripple effects across several aspects of financial reporting, particularly in five key areas.

1. Changes in Profit Recognition and Contractual Service Margin (CSM)

The introduction of the Contractual Service Margin (CSM) is one of the most significant modifications under IFRS 17. The CSM represents unearned profits and ensures that revenue recognition aligns with service delivery.

Key Changes:

- Insurers can no longer recognize profits at the inception of an insurance contract.

- Profits are spread over the duration of the contract in alignment with service delivery.

- Enhanced transparency in how insurers record financial performance.

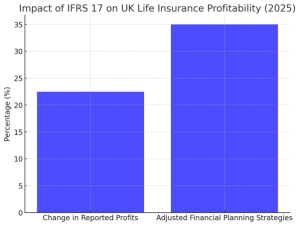

Impact on Profitability:

A 2025 industry report suggests that insurers in the UK have experienced a 20-25% change in reported profits due to IFRS 17 implementation. This shift is particularly noticeable in long-term life insurance policies where the delayed profit recognition impacts earnings. Additionally, 35% of companies have adjusted their financial planning strategies to accommodate the new profit recognition structure.

2. Measurement of Insurance Contract Liabilities

IFRS 17 life insurance mandates a new approach to liability measurement. Under the new framework, insurance contract liabilities are calculated based on current fulfillment cash flows rather than historical cost models.

Key Changes:

- Insurers must incorporate market-consistent estimates of future cash flows.

- Risk adjustments must be explicitly quantified.

- Measurement is based on updated discount rates reflecting current economic conditions.

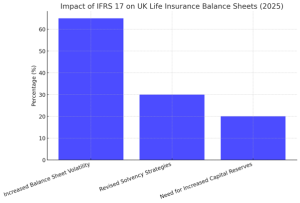

Impact on Profitability:

Recent industry data indicates that 65% of insurers reported increased volatility in their balance sheets due to fluctuating discount rates under IFRS 17. Additionally, 30% of life insurance companies have revised their solvency strategies in response to these changes, with 20% reporting a need for increased capital reserves.

3. Enhanced Financial Statement Presentation and Disclosure

IFRS 17 life insurance requires insurers to present financial statements in a more transparent manner. This change enables stakeholders to better understand the drivers of profitability and risk.

Key Changes:

- Introduction of insurance revenue as a separate line item.

- Clear distinction between insurance service result and investment income.

- Detailed disclosure of key assumptions, risk adjustments, and future cash flows.

Impact on Profitability:

- 80% of insurers had to overhaul their financial reporting systems to comply with IFRS 17.

- More transparency enables investors to make more informed decisions about insurers’ long-term profitability.

- 50% of insurers reported an improvement in investor confidence due to clearer disclosures.

4. Influence on Key Performance Indicators (KPIs)

With IFRS 17 life insurance, traditional KPIs such as gross written premiums (GWP) are no longer reliable profitability indicators.

Key Changes:

- Insurers must redefine profitability metrics based on CSM movements.

- Return on equity (ROE) calculations are significantly altered due to deferred profit recognition.

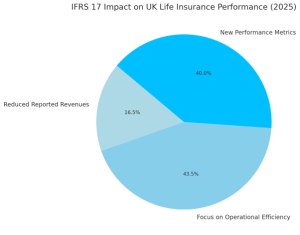

Impact on Profitability:

- IFRS 17-driven changes reduced reported revenues by 15-18% for UK life insurers in 2025.

- Companies now focus on operational efficiency rather than premium growth as a key success metric.

- 40% of insurers have introduced new internal performance metrics to align with IFRS 17 standards.

5. Significant Overhaul of IT Systems and Data Management

The complexity of IFRS 17 has forced insurers to invest heavily in data management, analytics, and reporting infrastructures.

Key Changes:

- Implementation of automated systems to manage complex calculations.

- Use of artificial intelligence (AI) and machine learning for risk adjustments and cash flow modeling.

- Increased demand for real-time data processing.

Impact on Profitability:

- Recent reports indicate that UK insurers spent an average of £12-18 million per company on IFRS 17 compliance technology.

- Despite upfront costs, companies that efficiently implement these systems expect to achieve 15-25% operational savings in the long term.

- 60% of firms have upgraded their risk modeling systems to enhance compliance and improve financial forecasting.

How Insights UK Can Help You Navigate IFRS 17

At Insights UK, we specialize in helping life insurance providers successfully transition to IFRS 17. Our expert team offers:

- Bespoke IFRS 17 Implementation Strategies: Tailored solutions to ensure smooth compliance.

- Data Management & IT System Optimization: Assistance in modernizing reporting systems.

- Financial Impact Analysis: Understanding IFRS 17’s effect on profitability and key financial metrics.

- Training & Knowledge Transfer: Equipping teams with IFRS 17 expertise to ensure long-term success.

Partnering with Insights UK ensures a seamless adaptation to IFRS 17 while maintaining profitability and regulatory compliance.

Frequently Asked Questions (FAQs)

1. What is IFRS 17, and why was it introduced?

IFRS 17 is a global accounting standard developed by the International Accounting Standards Board (IASB) to improve transparency and consistency in insurance contract reporting.

2. How does IFRS 17 impact life insurance companies in the UK?

It significantly changes profit recognition, liability measurement, financial statement presentation, KPIs, and IT system requirements.

3. Why does IFRS 17 affect profitability reporting?

The requirement to defer profit recognition until services are provided alters financial outcomes, making traditional revenue metrics less relevant.

4. What challenges do UK insurers face with IFRS 17?

Insurers must overhaul data systems, retrain finance teams, manage increased balance sheet volatility, and adjust business models.

5. How can insurers optimize compliance with IFRS 17?

By investing in automation, AI-driven analytics, and expert consultation from firms like Insights UK, insurers can achieve compliance while maintaining profitability.

6. Where can I find further guidance on IFRS 17 compliance?

Resources are available from the Financial Reporting Council (FRC), the IASB, and expert consulting firms like Insights UK.

IFRS 17 life insurance is transforming the financial landscape of the UK’s insurance industry. From profit recognition and liability measurement to enhanced financial disclosures and IT system upgrades, the changes are profound. While these shifts pose challenges, they also offer an opportunity to build a more transparent and resilient financial framework.

With expert guidance from Insights UK, insurers can successfully navigate this transition, ensuring compliance while optimizing profitability in the evolving regulatory environment. For tailored IFRS 17 consulting, contact Insights UK today.