In the evolving landscape of financial reporting, understanding the treatment of goodwill and intangible assets under the Financial Reporting Standard (FRS) 102 is crucial for entities operating in the United Kingdom. This guide provides an in-depth analysis of the recognition, measurement, and recent amendments related to goodwill and intangible assets, incorporating the latest data and developments up to 2025. Additionally, we explore how Insights UK can assist businesses in navigating these complexities.

Introduction to FRS 102

FRS 102 serves as the principal financial reporting standard for entities in the UK and the Republic of Ireland that are not applying International Financial Reporting Standards (IFRS), FRS 101, or FRS 105. It aims to provide a consistent framework for financial reporting, ensuring transparency and comparability across financial statements.

Defining Goodwill and Intangible Assets

Goodwill arises when an entity acquires another business for a price exceeding the fair value of its identifiable net assets. This excess represents non-physical assets such as brand reputation, customer relationships, and intellectual property that contribute to future economic benefits.

Intangible assets, distinct from goodwill, are identifiable non-monetary assets without physical substance. Examples include patents, trademarks, copyrights, and internally developed software. These assets are either separable or arise from contractual or other legal rights.

Recognition and Measurement

Initial Recognition

Under FRS 102, the approach to recognizing intangible assets and goodwill varies based on their acquisition method:

- Separately Acquired Intangible Assets: These are recognized at cost, encompassing the purchase price and any directly attributable costs necessary to prepare the asset for its intended use.

- Intangible Assets Acquired in a Business Combination: Such assets are recognized separately from goodwill if they are identifiable and their fair value can be measured reliably.

- Internally Generated Intangible Assets: Recognition depends on whether the asset meets the definition of an intangible asset and satisfies specific recognition criteria. Notably, research costs are expensed as incurred, while development costs may be capitalized if certain conditions are met.

Measurement After Recognition

Post initial recognition, entities can measure intangible assets using:

- Cost Model: The asset is carried at cost less any accumulated amortization and impairment losses.

- Revaluation Model: Applicable only if fair value can be determined by reference to an active market, which is uncommon for many intangible assets. Under this model, the asset is carried at a revalued amount, being its fair value at the date of revaluation less subsequent amortization and impairment losses.

Amortization and Useful Life

Intangible assets and goodwill are amortized over their useful lives:

- Finite Useful Life: Amortization is conducted on a systematic basis over the asset’s estimated useful life. The method should reflect the pattern in which the asset’s future economic benefits are expected to be consumed.

- Indefinite Useful Life: FRS 102 requires entities to assign a finite useful life to all intangible assets and goodwill. If a reliable estimate cannot be made, the life shall not exceed ten years.

Impairment of Assets

Entities must assess at each reporting date whether there is any indication that an asset may be impaired. If such indications exist, the entity must estimate the recoverable amount of the asset and recognize an impairment loss if the carrying amount exceeds its recoverable amount.

Recent Amendments and Updates (2024-2025)

The Financial Reporting Council (FRC) has introduced several amendments to FRS 102, effective for accounting periods beginning on or after January 1, 2026, with early adoption permitted. Key changes include:

- Revenue Recognition: Aligning with IFRS 15, a new five-step model for revenue recognition has been introduced, potentially impacting the measurement and recognition of intangible assets related to customer contracts.

- Lease Accounting: Incorporating an on-balance sheet model for lessees, similar to IFRS 16, which may affect the recognition and measurement of intangible assets associated with lease agreements.

- Supplier Finance Arrangements: New disclosure requirements mandate entities to provide information about the terms and conditions of such arrangements. These amendments are effective from January 1, 2025.

- Clarification on Software Costs: Guidance has been provided on whether software costs should be capitalized as tangible or intangible assets. If software is integral to the functioning of an item of property, plant, or equipment (PPE), its costs should be capitalized as part of that PPE; otherwise, they should be recognized as intangible assets.

Practical Implications for UK Entities

The amendments to FRS 102 necessitate a thorough review of existing accounting policies and practices:

- Contract Costs: Entities must evaluate the capitalization of costs to obtain or fulfill contracts, as changes may lead to fluctuations in reported margins over the contract period.

- Supplier Finance Arrangements: New disclosure requirements mandate entities to provide information about the terms and conditions of such arrangements, affecting financial statement presentation.

- Transition Planning: Early preparation is crucial. Entities should assess the impact of these changes on their financial statements, systems, and processes, and plan stakeholder communications accordingly.

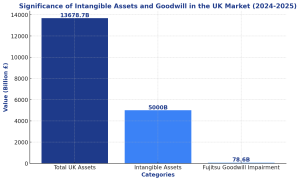

Recent data highlights the significance of intangible assets and goodwill in the UK market. For instance, in the third quarter of 2024, the UK’s asset position was valued at £13,678.7 billion, with intangible assets comprising a substantial portion of this valuation. This underscores the importance of accurate recognition and measurement of these assets under FRS 102.

Moreover, notable corporate events have brought attention to the treatment of goodwill. In January 2025, Fujitsu reported a £78.6 million impairment of goodwill in its UK business, primarily due to its decision to limit bidding for UK government contracts following the Post Office Horizon scandal. This impairment significantly impacted the company’s financial statements, highlighting the need for diligent assessment of goodwill valuations.

How Insights UK Can Assist

Navigating the complexities of FRS 102 requires expertise and tailored solutions. Insights UK offers comprehensive services to assist entities in:

- Impact Assessment: Evaluating how the amendments affect your financial reporting and identifying areas requiring policy changes.

- Policy Development: Assisting in the formulation of accounting policies that comply with the new standards while aligning with your business objectives.

- Training and Workshops: Providing bespoke training sessions to ensure your finance team is well-versed with the latest requirements and best practices.

- System Implementation: Advising on and assisting with the implementation of necessary system changes to capture and report information in compliance with the amended standards.

- Ongoing Support: Offering continuous support to address any challenges during the transition and beyond, ensuring sustained compliance and optimal financial reporting.

FAQs

1. What are intangible assets under FRS 102?

Intangible assets under FRS 102 are non-monetary assets without physical substance that can be identified either by being separable (capable of being sold, transferred, or licensed) or arising from contractual or legal rights. Examples include patents, trademarks, copyrights, customer lists, brands, and internally developed software. These assets must be capable of generating future economic benefits for the entity and should be measured reliably to be recognized in financial statements.

2. Is goodwill reported as an intangible asset?

No, goodwill is not classified as an intangible asset under FRS 102. Instead, it is reported separately as an asset on the balance sheet when it arises from a business combination. Goodwill represents the excess amount paid over the fair value of the net assets acquired and reflects factors such as brand reputation, customer relationships, and market positioning.

3. What is the useful life of goodwill under FRS 102?

Under FRS 102, goodwill must have a finite useful life and be amortized over that period. If the entity cannot make a reliable estimate of the useful life, it should not exceed ten years. Entities must review the useful life and amortization period annually to ensure they remain appropriate.

4. Can I revalue an intangible asset under FRS 102?

Under FRS 102, intangible assets can be measured using either the cost model or the revaluation model, but revaluation is only permitted if a reliable active market exists for the asset. Since many intangible assets, such as brands or internally developed software, do not have active markets, most entities use the cost model, where assets are carried at cost less amortization and impairment.

5. What are the 7 intangible assets?

The seven common types of intangible assets include:

- Patents – Exclusive rights to an invention or process.

- Trademarks – Distinctive symbols, logos, or names used for branding.

- Copyrights – Legal rights protecting original creative works.

- Franchises & Licenses – Agreements granting the right to operate under a business model.

- Customer Relationships – Established client bases and customer contracts.

- Brand Recognition & Reputation – The perceived value and awareness of a company’s brand.

- Internally Developed Software – Proprietary software created for business operations.

6. Is goodwill amortized under IFRS?

No, under IFRS (International Financial Reporting Standards), goodwill is not amortized. Instead, it is tested annually for impairment. If the carrying amount of goodwill exceeds its recoverable amount (the higher of fair value, less costs to sell or value in use), an impairment loss must be recognized. This differs from FRS 102, where goodwill must have a finite useful life and be amortized systematically.

The evolving landscape of financial reporting under FRS 102 presents both challenges and opportunities for UK entities. A thorough understanding of the treatment of goodwill and intangible assets, coupled with proactive adaptation to recent amendments, is essential for accurate and compliant financial reporting. Partnering experts like Insights UK can provide the necessary guidance and support to navigate these changes effectively.

Sources:

- https://www.icaew.com/technical/corporate-reporting/uk-gaap/frs-102-topics/intangible-assets

- https://www.frc.org.uk/library/standards-codes-policy/accounting-and-reporting/uk-accounting-standards/frs-102/

- https://www.rsmuk.com/insights/bridging-the-gaap/key-changes-to-frs-102-beyond-revenue-and-leases

- https://www.bdo.co.uk/getmedia/38fbdf0e-6ef9-4539-b3cb-a33df06dc7ba/FRS-102-Amendments-September-2024-v2.pdf