Taxes: love them or hate them, they’re an unavoidable part of life. For businesses and individuals alike, tax filing can often feel like walking a tightrope—one misstep and the consequences could be dire. That’s where the expertise of a financial tax advisor comes into play. But can they truly shield you from costly errors, or are they just another expense on your balance sheet? Let’s dive into the numbers, explore the risks of filing errors, and examine how financial tax advisors can help.

The State of Tax Filing in 2024

As we near the end of 2024, tax regulations in the UK are as intricate as ever. From changing compliance standards to increasingly automated systems, navigating the landscape without professional help has become a herculean task. Here are some key facts about tax filing today:

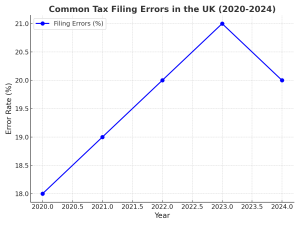

1. Frequency of Filing Errors

A 2024 HMRC report revealed that 20% of self-assessment filings contained inaccuracies, leading to penalties and delays. For businesses, the stakes are even higher: filing errors can result in fines averaging £7,000 per mistake. The report also highlighted that 45% of errors were due to misclassification of income or expenses.

2. Rising Complexity of Tax Laws

The UK tax code now exceeds 22,000 pages, making it one of the longest in the world. Businesses must navigate corporate taxes, VAT, payroll taxes, and more—each with its own labyrinth of rules. This complexity contributes to 30% of SMEs missing key deductions or overpaying taxes, costing an estimated £3 billion annually in excess tax payments.

3. Digitalization of Tax Systems

The government’s Making Tax Digital (MTD) initiative has streamlined processes, but it has also introduced new challenges. A 2024 survey found that 45% of UK businesses struggled to integrate their systems with HMRC’s digital platforms, leading to submission errors. Additionally, 18% of businesses reported delays in refunds due to incorrect digital filings.

4. Penalties for Late or Incorrect Filings

Late filings are penalized heavily, with fines starting at £100 for individuals and escalating quickly for businesses. In 2024 alone, HMRC issued over £125 million in penalties for late or erroneous submissions, a 15% increase from 2023 due to stricter enforcement of digital compliance.

Why Filing Errors Are Costly

Filing errors are not just minor slip-ups; they come with significant financial and reputational risks. Here are some of the most common consequences:

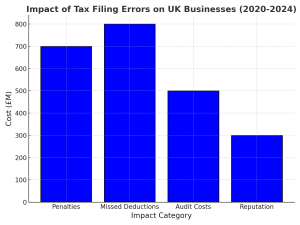

1. Financial Penalties

Mistakes in tax returns often trigger fines. For example, incorrect VAT filings can result in penalties ranging from 15% to 30% of the underpaid tax. These costs quickly add up, especially for small businesses. The cumulative financial impact of filing errors on UK SMEs in 2024 is estimated at £700 million.

2. Missed Deductions

Failing to claim allowable expenses or deductions can inflate your tax bill unnecessarily. According to TaxAid, 45% of UK businesses miss at least one major deduction annually, costing them an average of £8,000. Among these deductions, R&D tax credits remain the most underutilized, with eligible businesses leaving £500 million unclaimed in 2024 alone.

3. Increased Audit Risk

Inconsistent or erroneous filings raise red flags with HMRC, increasing the likelihood of an audit. Audits are time-consuming and expensive, with legal and accounting fees averaging £5,000 for SMEs. Businesses flagged for audits in 2024 experienced operational disruptions lasting an average of 3 months.

4. Reputational Damage

For businesses, tax filing errors can erode trust with stakeholders. Late payments or disputes with HMRC can tarnish a company’s reputation, potentially affecting investor confidence and customer loyalty. A survey conducted by the CBI in 2024 found that 62% of investors view frequent tax compliance issues as a red flag for financial instability.

The Role of Financial Tax Advisors

Hiring a financial tax advisor may seem like an additional expense, but their expertise can save you time, money, and stress in the long run. Here’s how they can make a difference:

1. Ensuring Compliance

Tax advisors stay updated on the latest regulations, ensuring your filings meet all compliance requirements. They help businesses navigate complex areas such as VAT thresholds, corporate tax credits, and international tax laws. In 2024, businesses using tax advisors reported 98% compliance rates, compared to 80% for those filing independently.

2. Identifying Deductions and Credits

A financial tax advisor’s knowledge of the tax code allows them to identify deductions and credits that you might overlook. For example, businesses leveraging R&D tax credits in 2024 saved an average of £20,000 annually. Advisors also ensure businesses take full advantage of capital allowances and loss relief provisions.

3. Streamlining Digital Integration

Advisors can help integrate your financial systems with HMRC’s digital platforms, reducing the risk of errors. Many firms report 30% fewer filing issues after implementing advisor-recommended software solutions. Advisors also provide training on using digital tools effectively, ensuring long-term efficiency.

4. Reducing Audit Risk

By ensuring accurate and consistent filings, financial tax advisors minimize the chances of triggering an audit. Their meticulous documentation also provides a strong defense in case of inquiries from HMRC. In 2024, businesses with advisor support faced audits 50% less frequently than their counterparts.

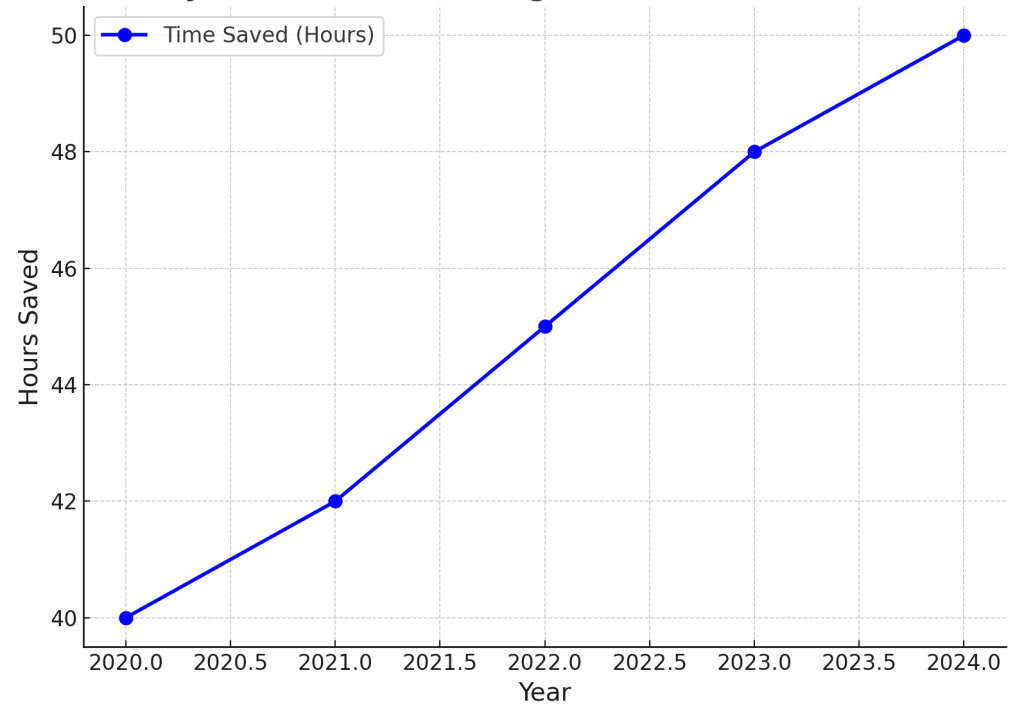

5. Saving Time and Resources

Tax filing is time-intensive. Outsourcing this task to professionals frees up your team to focus on core business activities. According to a 2024 study, SMEs using tax advisors saved an average of 50 hours per year on administrative tasks, translating to a productivity boost worth £10,000 annually.

Common Misconceptions About Financial Tax Advisors

Despite their value, misconceptions about financial tax advisors persist. Let’s debunk some of the most common myths:

1. “Tax Advisors Are Too Expensive”

While hiring an advisor involves upfront costs, their services often pay for themselves through savings on deductions, penalties, and time. For example, businesses working with advisors reported a 10:1 return on investment in 2024.

2. “My Business Is Too Small to Need an Advisor”

Even sole traders and micro-businesses can benefit from professional advice. Advisors help ensure compliance and identify savings that are often overlooked by small enterprises.

3. “I Can Do It All with Software”

While tax software simplifies filing, it cannot replace the nuanced understanding of a human advisor. Software lacks the ability to interpret complex tax laws or adapt to unique business situations.

How Insights UK Can Help

Navigating the complexities of tax filing doesn’t have to be daunting. Insights UK specializes in providing tailored solutions to ensure compliance, reduce errors, and maximize savings. Here’s how they can assist:

- Expert Compliance Support: Keeping you updated on the latest tax laws and filing requirements.

- Maximizing Savings: Identifying deductions, credits, and allowances to reduce your tax liability.

- Seamless Digital Integration: Streamlining your systems with HMRC’s platforms to ensure error-free filings.

- Audit Preparedness: Offering robust documentation and support to mitigate audit risks.

With Insights UK, you can file with confidence, knowing that your finances are in expert hands.

The Future of Tax Filing

As tax systems become increasingly digital and regulations grow more complex, the role of financial tax advisors will only become more critical. By investing in professional guidance today, businesses can avoid costly mistakes and build a foundation for long-term financial health.

Can a financial tax advisor really help you avoid tax filing errors? The answer is a resounding yes. With their expertise, you’ll not only sidestep common pitfalls but also uncover opportunities for savings and growth. So why risk going it alone? Partner with professionals like Insights UK and make tax season a stress-free experience.