The United Kingdom’s startup ecosystem has grown exponentially over the past decade, positioning itself as a hub for innovation and entrepreneurship. However, investing in startups remains fraught with challenges, and at the core of these challenges are due diligence risks. With changing economic landscapes, technological advancements, and increasingly complex regulatory frameworks, the question arises: Are due diligence risks making startup investments more hazardous?

The key factors amplifying these risks, the implications for investors, and how entities like Insights UK can mitigate these challenges. Supported by data, insights, and expert perspectives, we delve into the growing importance of robust due diligence practices in navigating the UK startup investment landscape.

The Current Landscape of Startup Investments in the UK

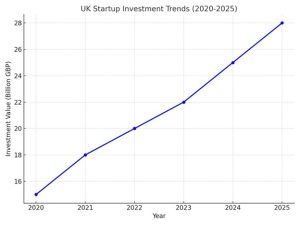

The UK has solidified its position as one of the top destinations for startup investments, driven by sectors such as fintech, health tech, and green energy. According to a 2025 report by the UK Business Angel Association, over £25 billion was invested in startups in 2024, reflecting a 12% year-on-year growth. Despite this impressive growth, a significant proportion of these investments struggle to yield expected returns due to overlooked risks during the due diligence process.

Key challenges include:

- Evolving Regulatory Environments: Post-Brexit regulatory changes and new compliance requirements add layers of complexity for startups and investors.

- Underestimated Market Risks: Rapidly changing market conditions, especially in volatile sectors like crypto and fintech, amplify risks.

- Intangible Asset Valuations: For technology-driven startups, valuing intangible assets like intellectual property often becomes a contentious issue.

In addition, the regional disparities in startup growth and investment highlight the need for localized strategies. London remains the epicenter of startup activity, but cities like Manchester, Edinburgh, and Cardiff are emerging as potential hotspots. This diversification necessitates a more nuanced approach to due diligence.

Understanding Due Diligence Risks in Startup Investments

The term due diligence risks encompasses a variety of pitfalls that investors face while evaluating startups. These risks typically arise from insufficient or inaccurate assessments of a company’s financial health, market potential, operational framework, and compliance standards.

Key Components of Due Diligence Risks:

- Financial Due Diligence Risks:

- Misrepresentation of financial data.

- Overestimated revenue projections.

- Hidden liabilities or debt.

- Operational Due Diligence Risks:

- Inefficiencies in processes or supply chains.

- Inadequate infrastructure to scale operations.

- Regulatory and Legal Due Diligence Risks:

- Non-compliance with local and international laws.

- Pending lawsuits or unresolved legal disputes.

- Market and Competitive Risks:

- Overestimating market demand.

- Underestimating competition or disruptive technologies.

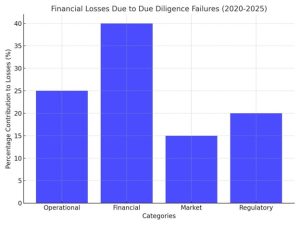

68% of startup failures in the UK can be attributed to inadequate due diligence. Moreover, nearly 40% of investors surveyed admitted to skipping comprehensive due diligence in at least one investment decision due to time constraints or overconfidence in founders.

Quantifying the Impact of Due Diligence Risks

Financial Implications:

Investors facing due diligence risks often suffer significant financial losses. The average loss per failed startup investment in the UK is approximately £1.5 million, with due diligence oversights accounting for over 50% of these failures.

Reputational Damage:

Beyond monetary losses, poorly executed due diligence can harm an investor’s reputation, particularly for venture capital firms. Investors associated with failing startups may struggle to attract co-investors for future opportunities.

Impact on Ecosystem Growth:

Due diligence risks also have broader implications for the UK’s startup ecosystem. Increased failures lead to reduced investor confidence, creating a more risk-averse environment that hampers innovation.

Emerging Trends in Addressing Due Diligence Risks

To counter due diligence risks, investors are increasingly leveraging technology, data, and specialized expertise. Below are some emerging trends reshaping the due diligence landscape:

1. Big Data and Predictive Analytics:

Big data analytics is revolutionizing due diligence by enabling investors to assess market trends, competitor movements, and customer behaviors with greater accuracy. For instance, predictive analytics tools can highlight red flags in financial data or identify undervalued opportunities.

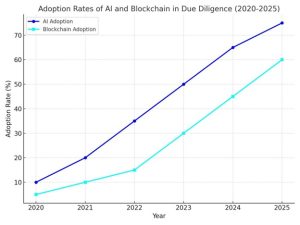

2. Artificial Intelligence (AI) in Due Diligence:

AI-driven platforms like Valuer.ai are simplifying the due diligence process by automating data analysis, generating risk profiles, and offering scenario-based forecasts. According to a 2025 survey by Tech Nation, 55% of UK investors now rely on AI tools for preliminary due diligence.

3. Blockchain for Transparency:

Blockchain is gaining traction as a tool to enhance transparency in due diligence. By providing immutable records of a startup’s financial transactions, intellectual property rights, and compliance history, blockchain reduces the risk of data manipulation.

4. Collaborative Due Diligence Platforms:

Increasingly, collaborative platforms are being developed to streamline the due diligence process. These platforms enable investors, legal advisors, and analysts to work in unison, ensuring that all aspects of a startup’s operations are scrutinized comprehensively.

Insights UK: Mitigating Due Diligence Risks for Investors

Navigating due diligence risks requires expertise, technology, and a deep understanding of the startup ecosystem. Insights UK has emerged as a trusted partner for investors seeking to mitigate these risks effectively.

How Insights UK Can Help:

- Comprehensive Due Diligence Services: Insights UK provides end-to-end due diligence services that encompass financial, operational, legal, and market evaluations. By combining traditional methods with advanced analytics, they deliver detailed risk assessments.

- Sector-Specific Expertise: Whether it’s fintech, health tech, or green energy, Insights UK offers tailored solutions that account for industry-specific dynamics and regulatory requirements.

- Post-Investment Monitoring: Beyond initial due diligence, Insights UK provides ongoing monitoring services to help investors track the performance and compliance of their portfolio companies.

Future Outlook: Strengthening Due Diligence Practices

The future of startup investments in the UK hinges on minimizing due diligence risks through innovation and collaboration. Key recommendations for investors include:

- Investing in Technology: Leveraging AI, big data, and blockchain to enhance due diligence accuracy and efficiency.

- Building Expertise: Partnering with specialized firms like Insights UK to access industry-specific knowledge.

- Fostering Transparency: Advocating for greater transparency from startups regarding financials, operations, and compliance.

- Adopting Continuous Monitoring: Shifting from one-time evaluations to ongoing assessments of startup performance and risk.

Moreover, investors must adapt to evolving market conditions by staying informed about emerging trends. As technology continues to reshape the due diligence landscape, a proactive approach will be critical to minimizing risks and maximizing returns.

Increased competition, regulatory complexities, and technological advancements have amplified due diligence risks, making startup investments more hazardous. However, these challenges also present opportunities for innovation and growth. By adopting advanced tools, fostering expertise, and partnering with trusted firms like Insights UK, investors can navigate these risks effectively and maximize returns. As the UK continues to lead in global startup innovation, addressing due diligence risks will be pivotal in sustaining its growth trajectory.