As the end of the year approaches, many London firms are faced with the challenging task of closing accounts and compiling financial reports. Outsourcing accounting tasks can help to streamline the process, decrease errors, and free up time for vital initiatives. In this article, we will explain seven ideas for a seamless year-end through accounting outsourcing, as well as how Insights can help your London-based business.

9 key signs that indicate it’s time to make the switch:

1. You’re Unsure About Your Financial Knowledge

Keeping track of complex financial tasks like tax compliance, auditing, and bookkeeping requires specialised expertise. If you’re unsure about managing these tasks, you risk making costly errors.

2. Invoicing or Payments Are Consistently Late

Late invoicing and delayed payments can choke your cash flow. When these tasks are left unattended, you risk causing cash flow disruptions that could affect your business operations.

3. You’re Lagging Behind in Technology

Keeping up with the ever-changing landscape of accounting technology can be challenging, especially if your team isn’t equipped with the latest tools.

4. You’re Not Fully Optimising Your Tax Returns

Navigating tax laws and ensuring you’re making the most of tax deductions and credits can be tricky. Without expert guidance, your business might miss out on significant tax savings.

5. You’re Struggling to Find Time for Business Growth

Handling financial responsibilities can be time-consuming, especially when trying to balance them with core business tasks.

6. Limited Resources Prevent You from Hiring In-House Accounting

Maintaining a full-time in-house accountant or team can be expensive, particularly for smaller businesses.

7. Decision-Making Feels Like a Challenge

Making informed decisions is crucial to business success, but without clear financial insights, this can become challenging.

8. Rapid Growth or Business Stagnation Is Overwhelming

Whether your business is growing rapidly or struggling to keep up with market demands, outsourcing your accounting can help.

9. You’re Constantly Worried About Finances

Financial concerns add stress to an already challenging business environment. When you outsource your accounting, you gain peace of mind knowing that your financial matters are in capable hands.

Here are the 7 Tips for Outsourcing Accounting in London

1. Begin Early with Year-End Planning.

Planning is essential for avoiding last-minute stress. Businesses that start year-end preparations at least 6 months ahead have reported a 40% reduction in year-end problems.

2. Ensure compliance with regulatory standards.

Outsourcing firms keep up with the current rules, lowering the risk of noncompliance by 95%. They also guarantee that your reports follow all applicable legal standards, such as UK GAAP or IFRS.

3. Streamline Payroll and HR Services.

Payroll and HR errors can cause year-end reporting delays and compliance issues. Outsourcing payroll decreases errors by 65% while ensuring that your year-end reports are correct.

4. Use cloud-based accounting solutions.

Using cloud accounting solutions can cut human errors by 70% while increasing efficiency. Cloud-based systems offer real-time access to financial data, making it easy to monitor progress throughout the year.

5. Concentrate on core business activities.

Outsourcing can save firms up to 30% on annual operational costs, allowing them to focus on growth rather than administration.

6. Get expert financial advice.

Outsourced accounting services frequently give skilled financial guidance, allowing businesses to save up to 15% on taxes by implementing effective tax planning tactics.

7. Improve scalability and flexibility.

Outsourcing enables firms to increase their accounting requirements without incurring the administrative costs of recruiting an in-house workforce. This flexibility has helped 50% of London’s SMEs better manage seasonal workload swings.

How Insights Can Help

Insights provides comprehensive accounting outsourcing services that allow businesses to focus on growth without worrying about financial management. With expertise in tax planning, payroll management, compliance, and more, we offer tailored solutions that adapt to your business’s unique needs.

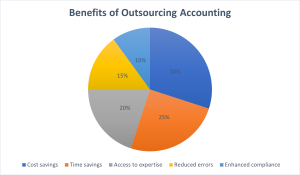

By outsourcing your accounting to Insights, you’ll benefit from:

- Reduced financial errors.

- Advanced reporting systems that deliver real-time insights.

- Enhanced compliance with changing regulations.

- More time and resources to focus on business growth.

Whether you’re looking for assistance with year-end preparations, payroll management, or overall financial strategy, we are ready to help you streamline operations and maximise efficiency.